Shares of Wipro declined sharply on Monday, plunging nearly 10% in early trade, after the IT major issued a soft revenue outlook for the fourth quarter and reported muted deal wins. The sell-off marked Wipro’s steepest single-day fall since July 2024, reflecting growing investor concerns over near-term growth visibility.

The stock slipped to around ₹248.75, emerging as the biggest percentage loser on the Nifty 50 as well as the Nifty IT index. Broader markets also witnessed pressure, with the benchmark index and the IT pack trading lower during the session.

Weak Growth Guidance and Deal Pipeline

Wipro indicated that its Q4 revenue is expected to remain flat to grow up to 2% sequentially, even after factoring in contributions from recent acquisitions. Additionally, the company’s total deal bookings for Q3 stood at $3.34 billion, the lowest level in the last six quarters, raising questions over future order inflows.

Market participants reacted negatively to the subdued numbers, as analysts flagged slower deal closures and delays in project ramp-ups as key reasons behind the weaker-than-expected outlook for the March quarter.

ADR Pressure Adds to Concerns

Adding to the bearish sentiment, Wipro’s American Depositary Receipts (ADRs) had already dropped over 7% on Friday, following the announcement of its third-quarter results, signalling continued pressure from global investors.

Peers Show Relative Strength

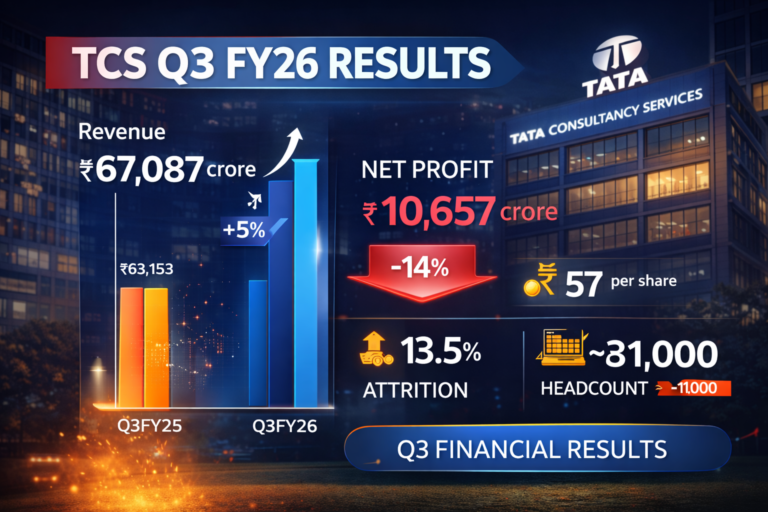

Wipro’s cautious outlook stood in contrast to larger rivals Tata Consultancy Services and Infosys, which reported healthier deal pipelines and better-than-expected revenue growth, despite a seasonally weak quarter for the IT sector.