The Life Insurance Corporation of India (LIC) is set to take steps to improve returns from its extensive real estate holdings, which currently have a book value of around ₹16,000 crore after revaluation and an estimated market value exceeding ₹45,000 crore, according to officials.

While rental yields from real estate assets typically remain in the 3–4% range, LIC officials noted that long-term capital appreciation from these properties has been substantial. The insurer is now reviewing its entire property portfolio to identify avenues for enhancing income generation.

No Immediate Plans to Sell Properties

Officials clarified that outright sale of properties is not an immediate priority. Instead, the focus is on strengthening recurring returns from existing assets. LIC is also open to evaluating new structures such as REIT-like models, though no formal decision has been taken so far.

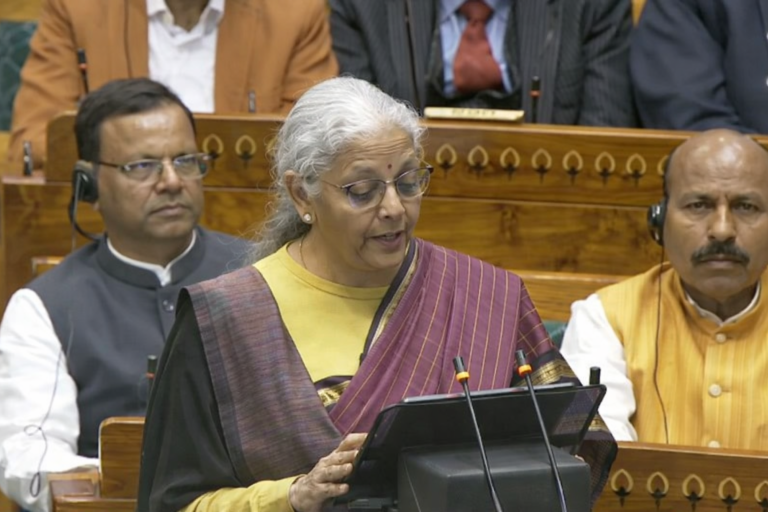

In her Union Budget address, Finance Minister Nirmala Sitharaman had announced plans to accelerate monetisation of large real estate assets held by central public sector enterprises through dedicated REIT frameworks, which could provide future opportunities for LIC.

Health Insurance Entry Put on the Back Burner

Addressing reporters after a board meeting, LIC’s Managing Director and CEO R Doraiswamy said the corporation has decided to move cautiously on its earlier proposal to enter the health insurance segment.

“There was a proposal to participate as a strategic investor in a standalone health insurance company to gain market understanding. However, after evaluating various options, we believe it is not immediately necessary,” he said, adding that LIC would reconsider the move if a suitable opportunity arises in the future.

Strong Financial Performance Continues

For the quarter ended December 2025, LIC reported a standalone net profit of ₹12,958 crore, marking a 17.2% increase compared to ₹11,056 crore in the same period last year.

Profit before tax rose 16.7% to ₹12,897 crore, while net premium income climbed 17.5% to ₹1.25 lakh crore, driven by strong growth in new business and single premium products.

NSE Stake Decision Still Pending

LIC has also not yet taken a final decision on selling its stake in the National Stock Exchange of India (NSE), where it is a significant shareholder, ahead of the exchange’s proposed initial public offering.