India’s technology stocks remained under intense selling pressure on Friday, with heavyweight IT counters extending their losing streak amid growing concerns over artificial intelligence disruption and delayed expectations of interest rate cuts in the United States.

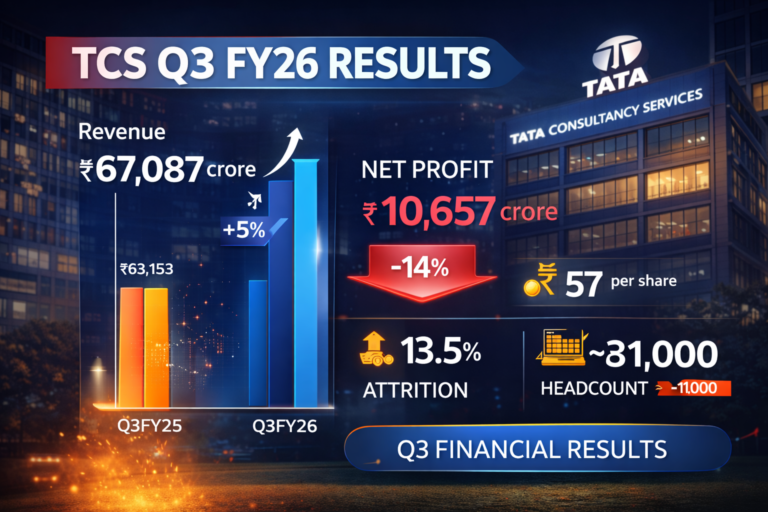

In early trade, the Nifty IT index slipped sharply, falling 4.6% to around 31,640, highlighting broad-based weakness across the sector. Infosys led the decline, dropping over 6% to near ₹1,300 on the NSE, while TCS lost nearly 5% to trade around ₹2,620. Other major players such as HCLTech, Wipro, and Tech Mahindra also traded deep in the red.

Mid-sized IT stocks mirrored the weakness, with Coforge, Persistent Systems, and LTIMindtree posting losses of up to 5%.

The latest downturn follows a poor showing in the previous session, when the IT index slipped close to its lowest level in nearly ten months, making it the weakest performing sector so far this year.

The pressure was not limited to domestic markets. In the US, American Depository Receipts of Infosys and Wipro extended losses for a second straight session. Infosys ADRs fell as much as 10% to about $14.2 on the New York Stock Exchange, while Wipro’s ADRs declined roughly 5%.

Market participants believe the selling could spill over to the broader technology space in the near term, keeping IT services stocks under close watch.

A key trigger behind the renewed anxiety is a recent announcement from Anthropic, the developer of the Claude platform. Investors fear that faster adoption of advanced AI tools could intensify competition, pressure margins, and erode the traditional advantages enjoyed by IT services firms.

According to VK Vijayakumar of Geojit Investments, technology stocks are unlikely to see a quick recovery following the latest AI-led shock. Some analysts estimate that a significant portion of industry revenues could be at risk if automation replaces work currently done by human employees.

Meanwhile, Motilal Oswal has also cautioned that AI could reduce the importance of traditional software development and testing contracts. However, the brokerage noted that potential partnerships and AI-focused collaborations over the next three to six months may open the door for new deal opportunities by mid-2026.