Adani Enterprises has reiterated its earlier stance while responding to queries raised by stock exchanges following a recent media report. The clarification came after BSE Limited and National Stock Exchange sought the company’s response under Regulation 30(11) of the SEBI listing norms.

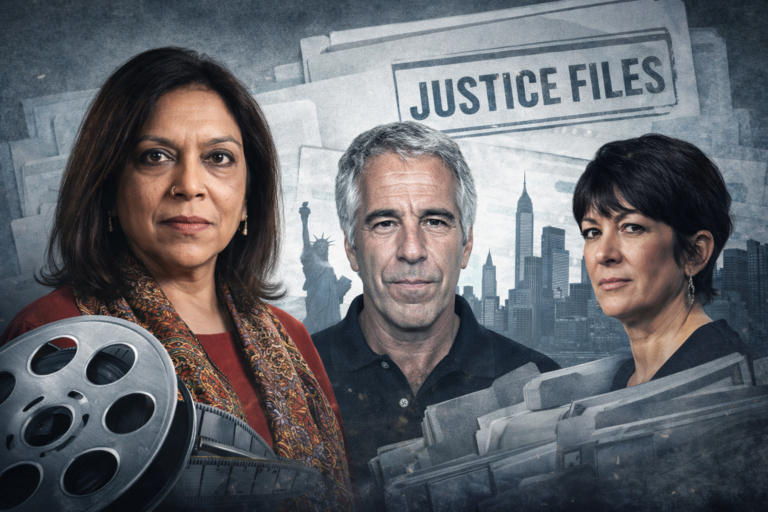

The exchanges sought clarification in connection with a Bloomberg report titled “US regulator seeking measures to serve Gautam, Sagar Adani legal summons.”

In its regulatory filing, Adani Enterprises stated that it had already clarified similar media queries on November 21, 2024, and maintained that position.

“There are no allegations made against the Company in, and the Company is not party to, these proceedings,” the company said.

The company further added that the media report does not warrant any disclosure under Regulation 30 read with Schedule III of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

The Bloomberg report had mentioned that the US Securities and Exchange Commission was seeking court approval to use alternative methods to serve legal notices to Gautam Adani and Sagar Adani. The report also noted that the information had not been independently verified.

Reiterating its stand, Adani Enterprises said the reported developments do not involve the company and have no impact on its disclosures, compliance obligations, or business operations. The company requested stock exchanges to take the clarification on record.

📊 Latest Price (approximate):

- 🔹 ₹1,864.20 on NSE (down significantly in recent sessions)

- 🔹 ₹1,862.80 on BSE (similar level)

💹 Recent Movement & Context:

- The stock has seen sharp volatility, including steep declines following legal news involving related group matters.

- Within the 52-week range, the share has traded between ₹1,848 (low) and about ₹2,612–₹2,695 (high).

📉 Market Sentiment:

- Recent decline partly reflects broader pressure on Adani Group stocks amid regulatory/legal headlines and market volatility.

👉 Note: These prices are approximate and generally reflect trading around 23–27 January 2026. For real-time quotes, please check a live stock market platform or brokerage feed (NSE/BSE data).