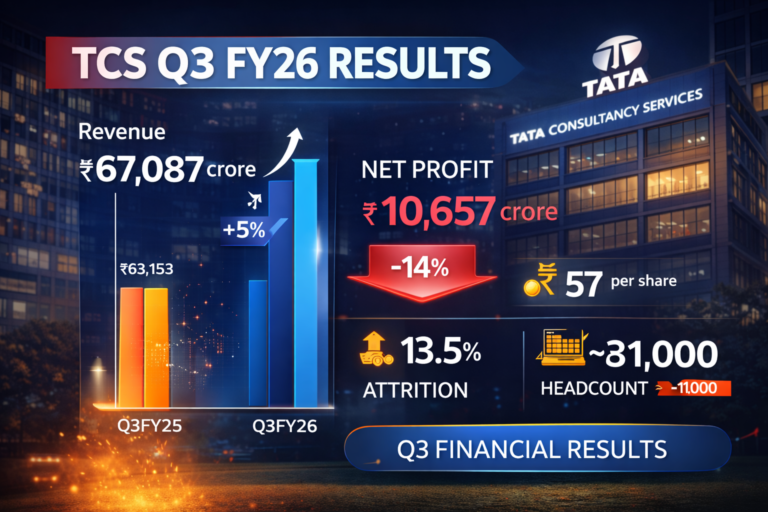

Tata Consultancy Services (TCS) reported its third quarter (October–December 2025) financial results today, showing a mix of growth and challenges against expectations.

Key Financial Metrics

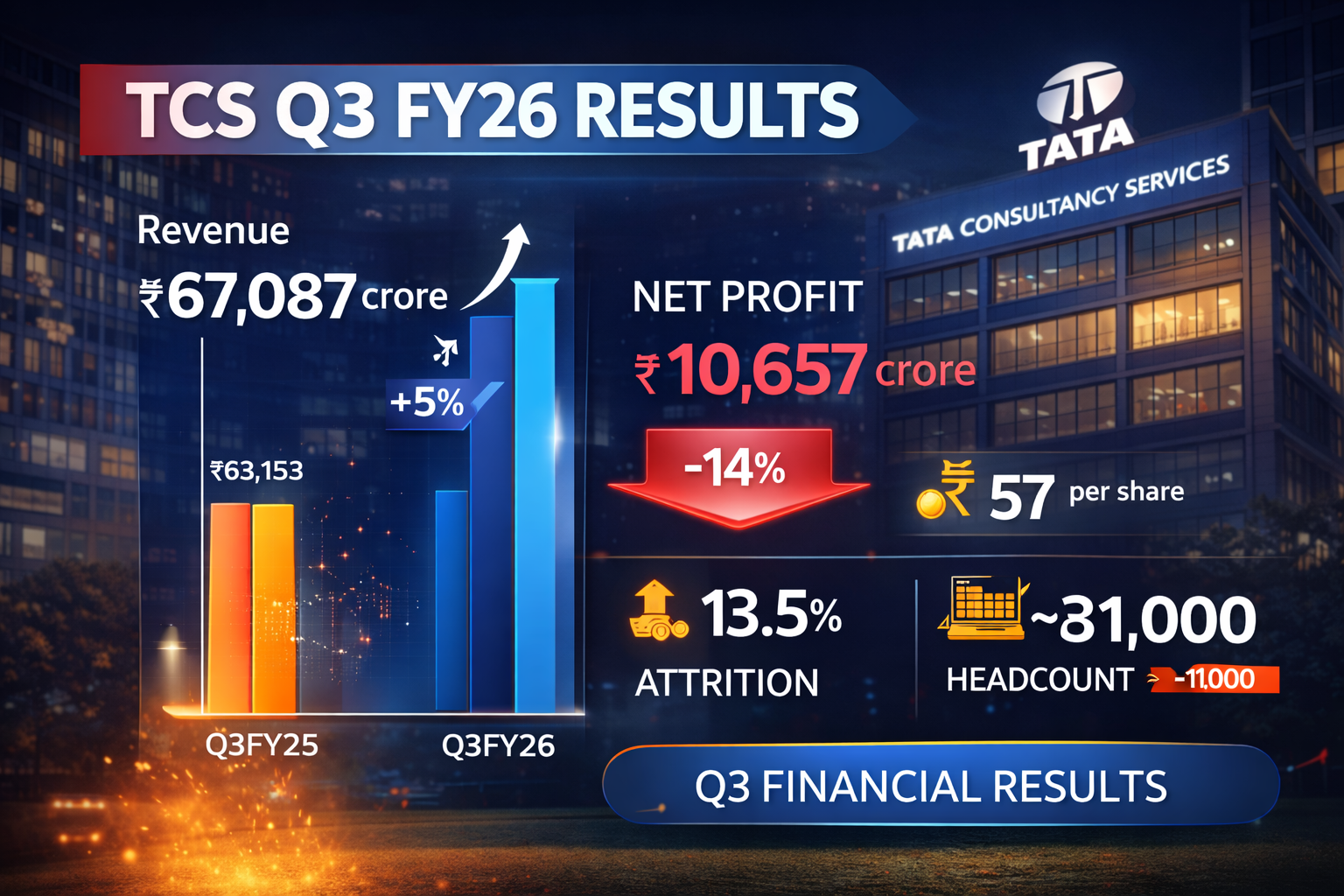

- Revenue (YoY): ₹67,087 crore, up ~5% from Q3FY25, beating expectations.

- Net Profit: ₹10,657 crore, down approximately 14% year-on-year largely due to exceptional items and labour code impacts.

- Dividend Declaration: A total dividend of ₹57 per share was announced, including interim and special payouts.

- Attrition & Workforce: Attrition rose slightly to 13.5%, and headcount dropped by over 11,000 employees sequentially.

What Drove the Results

Revenue Growth & AI Demand

TCS delivered modest top-line growth, supported by continued demand for digital transformation solutions and AI-related services. Annualised AI services revenue is estimated to be significant, reflecting the company’s push toward becoming an AI-led technology leader.

Net Profit Impacted by One-Off Costs

Profit was weighed down by:

- Statutory impact from new labour codes

- One-off legal and restructuring costs

These factors contributed to the year-on-year decline in net earnings despite top-line strength.

Dividend & Shareholder Returns

TCS reaffirmed its commitment to returns with a total dividend of ₹57 per equity share, a positive for long-term investors amid a mixed earnings backdrop.

Market and Sector Context

In a broader snapshot of the Indian IT sector:

- TCS’s performance reflects steady demand but also macro pressures affecting profitability.

- Peer tech companies like HCLTech also reported mixed Q3 results with their own challenges, such as net profit declines even as revenues grew.

Analyst and Market Reaction

Before the announcement, analysts anticipated:

- modest revenue and profit growth

- possible stock volatility post-earnings release

Shares saw minor pre-results pressure, underscoring investor focus on future demand visibility and margin trends.

In Brief: TCS Q3 FY26 Results (Snapshot)

| Metric | Q3 FY26 | YoY Trend |

|---|---|---|

| Revenue | ₹67,087 crore | + ~5% |

| Net Profit | ₹10,657 crore | – ~14% |

| Dividend | ₹57 per share | Declared |

| Attrition | 13.5% | Slight increase |

| Headcount | ~5.82 lakh | Declined |