Indian equity benchmarks staged a broad-based recovery by mid-session on Thursday, snapping a sharp fall seen in the previous trade. The Sensex jumped 605 points, or 0.73%, to 83,103, while the Nifty 50 climbed over 200 points, or 0.79%, to trade at 25,654 around 12:30 pm.

The rebound helped markets claw back a portion of Wednesday’s losses, when a steep sell-off had erased nearly ₹6.8 lakh crore from investor wealth.

Early Weakness, Gradual Recovery

The session began on a cautious note, with the Sensex opening lower at 82,272, compared with its previous close of 82,498. However, buying interest steadily emerged across heavyweight stocks and key sectors as the morning progressed, signalling a tentative return of risk appetite after the recent volatility.

Broader Markets Join the Rally

The recovery was not limited to frontline indices. Broader market gauges also moved higher, though gains were uneven:

- Nifty Next 50 advanced nearly 584 points to 69,560

- Nifty Bank rose about 597 points to 61,178

- Nifty Financial Services added over 217 points to 28,221

- Nifty Midcap 100 gained close to 396 points

- Nifty Smallcap 100 lagged, rising marginally by around 38 points

Top Gainers and Laggards

Among Nifty 50 stocks, metal and power names led the uptrend. Hindalco topped the gainers with a rise of about 3%, supported by strong volumes. Power Grid Corporation, NTPC, Larsen & Toubro, and Hindustan Unilever also posted solid gains of over 2% each, lending stability to the indices.

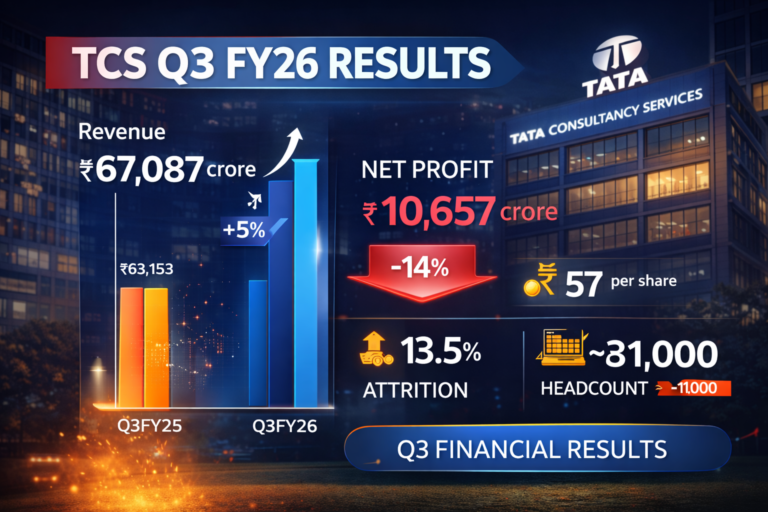

On the flip side, IT stocks remained under pressure. Infosys slipped nearly 1%, emerging as the most traded stock by value on the Nifty. Tech Mahindra, Eternal, Kwality Wall’s (India), and Mahindra & Mahindra also traded in the red, though losses were relatively contained.

Market Breadth Signals Caution

Despite the headline recovery, market breadth remained mixed. On the BSE, advancing stocks marginally outnumbered decliners, but the number of shares hitting 52-week lows exceeded new highs, highlighting continued underlying stress. Upper and lower circuit counts were broadly balanced, reflecting cautious sentiment among traders.

Global Cues Still a Risk

The intraday rebound followed some improvement in global sentiment, but uncertainties persist. Geopolitical tensions in West Asia, elevated crude oil prices, and concerns over supply disruptions through key shipping routes continue to pose risks. Meanwhile, US Federal Reserve signals of delayed rate cuts have kept the dollar firm, limiting upside for emerging market equities like India.

Outlook for the Rest of the Session

With trading still underway, market participants remain watchful. Analysts caution that the sustainability of the rebound will depend on global cues and institutional flows in the afternoon session, especially after the sharp volatility seen earlier in the week.